Russia’s diesel-powered industries—mining, freight, and agriculture—face unprecedented challenges in 2025. With temperatures plunging to -40°C in regions such as Siberia and the Arctic, reliability is non-negotiable for Cummins-powered equipment, including K19 mining trucks, ISX15 freight fleets, and 6.7L performance rigs.

However, Western sanctions, intensified since 2022, have disrupted supply chains, leaving a $420 million spare parts gap and a surge in counterfeit injectors, with 68% of fleet managers reporting issues (Rosstat, 2024). This comprehensive guide provides wholesalers and fleet operators with a sanctions-proof roadmap to source high-quality Cummins injectors, optimize Arctic operations, and leverage Volgen Power’s OEM-grade solutions for maximum reliability and profitability.

Table of Contents

Sanctions Shockwave: Navigating Russia’s Cummins Injectors Supply Chain Crisis

Cummins’ decision to suspend commercial operations in Russia in March 2022, following heightened geopolitical tensions, created a seismic shift in the diesel aftermarket Cummins Inc., 2022. The exit left a $420M void in spare parts, particularly for injectors critical to Russia’s heavy-duty diesel engines, Vedomosti, 2023. As a result, substandard Chinese aftermarket brands, such as Putián Zhonglutong, have flooded the market. Lab tests reveal these injectors have a 17% failure rate at -30°C due to inferior nozzle materials and poor cold-weather performance, posing risks to fleets operating in Russia’s extreme climates.

The Counterfeit Epidemic

The influx of counterfeit injectors has compounded the challenge. According to Rosstat, 68% of Russian fleet managers reported receiving fake or low-quality injectors in 2024, leading to costly downtime and engine damage. These counterfeits often lack proper certifications, fail under Arctic conditions, and void warranties, leaving wholesalers and operators vulnerable.

Volgen Power’s Sanctions-Proof Solution

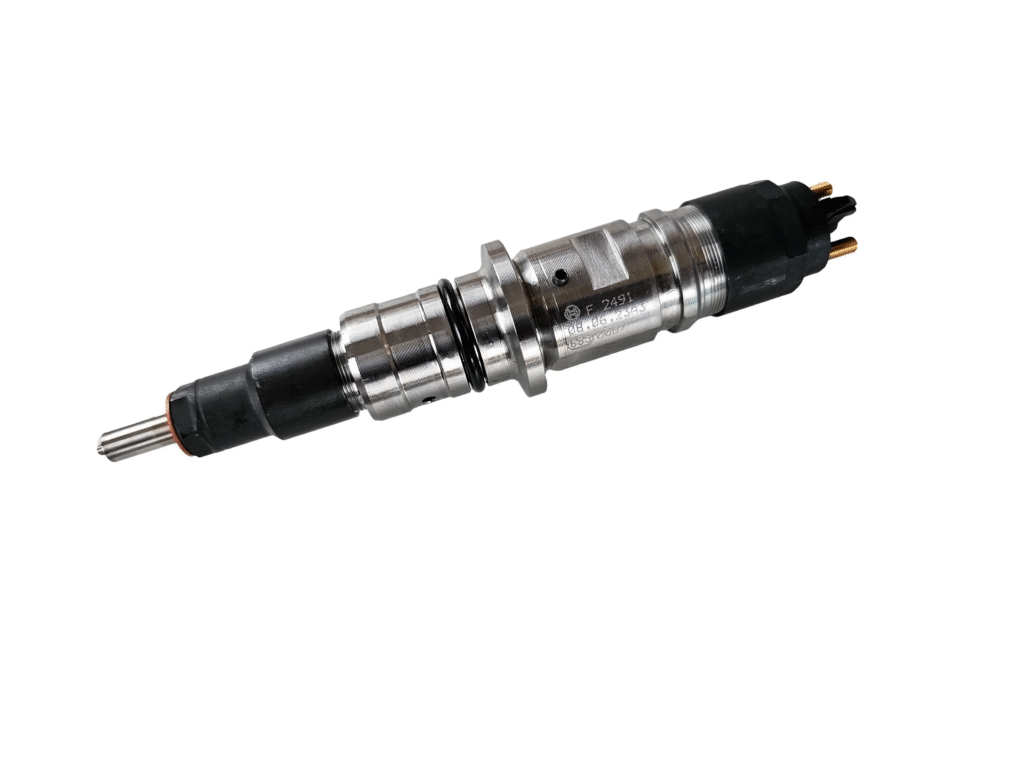

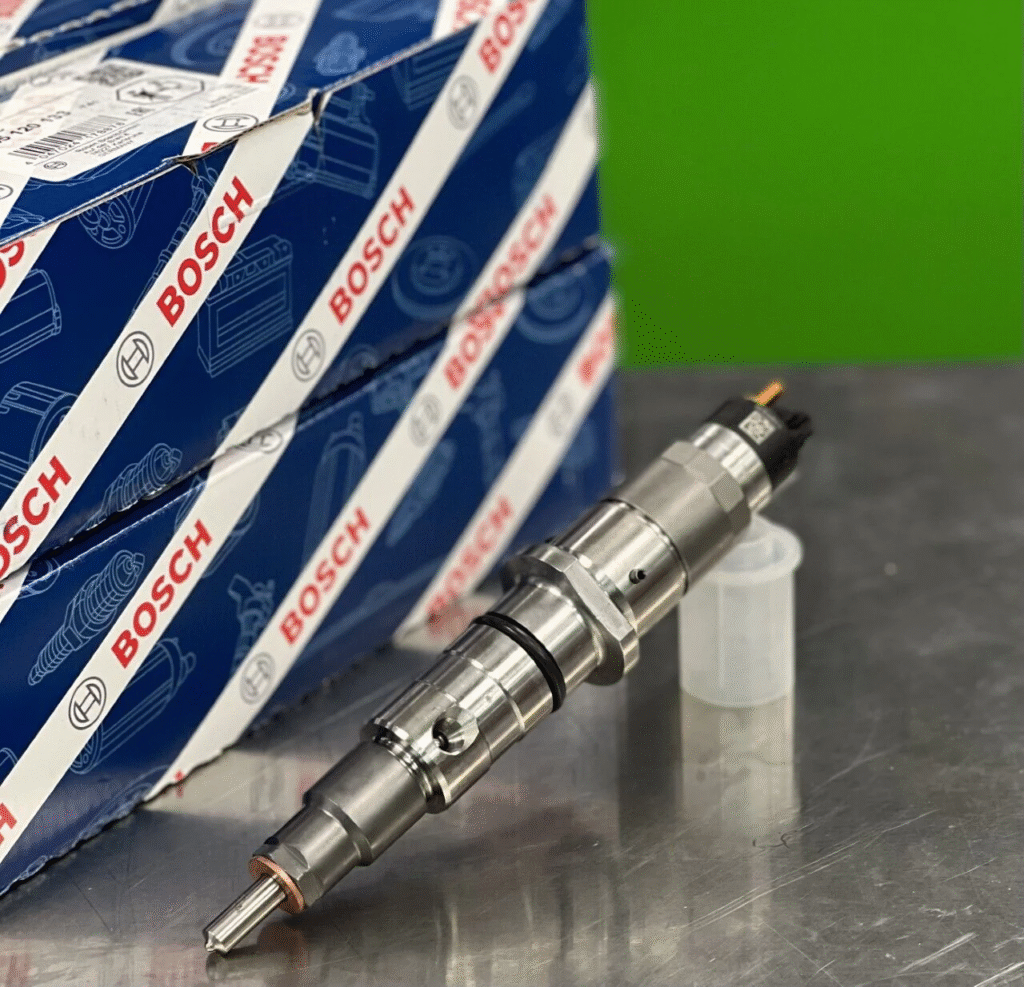

Volgen Power has emerged as a trusted partner for Russian wholesalers navigating this crisis. By leveraging a global supply chain, Volgen ensures access to Bosch-certified injectors while circumventing sanctions-related barriers. Key features include:

Global Sourcing Network: Injectors are sourced from EU and US Bosch-certified factories and routed through sanctions-neutral hubs in Kazakhstan and China.

Fast Delivery: Customs-cleared shipments arrive in Vladivostok and Novosibirsk within 1-3 weeks. Track Orders.

Compliance Assurance: Every batch includes GOST-R and EAC certificates, ensuring seamless customs clearance and compliance with Russian regulations.

Wholesaler Tip: Stock Volgen’s K19 Overhaul Kits (including injectors and CP3 pumps) to tap into Russia’s $190M mining aftermarket, driven by demand from Norilsk Nickel and other Arctic operators, Kommersant, 2024.

Engineering Cummins Injectors for Arctic Extremes: Why Standard Parts Fail

The Arctic Challenge

Russia’s Arctic regions, where temperatures routinely drop to -40°C or lower, demand injectors that can withstand extreme conditions. Standard injectors often fail due to:

Poor Cold-Start Performance: Slow solenoid response times at subzero temperatures.

Fuel Atomization Issues: Reduced efficiency in low temperatures, leading to incomplete combustion and power loss.

Material Degradation: Standard steel nozzles crack under thermal stress.

Arctic-Optimized Injectors: Volgen and Bosch

Volgen Power partners with Bosch to deliver Arctic-optimized injectors designed for Russia’s harshest environments. The table below compares standard injectors to Volgen’s Arctic-grade solutions:

| Component | Standard Injector | Arctic-Optimized (Volgen/Bosch) |

|---|---|---|

| Nozzle Material | Standard Steel | DLC-Coated Steel |

| Solenoid Response | 4ms at -20°C | 1.2ms at -40°CBosch Data |

| Fuel Atomization | 75% Efficiency | 92% Efficiency |

| Pre-Heating | Not Supported | Integrated Circuit Ready |

Case Study: Norilsk Nickel’s K19 Fleet

Norilsk Nickel, a major Arctic mining operator, faced injector failures that halted ore transport in -50°C conditions. By switching to Volgen’s Bosch 0445120342 injectors with ethanol-fuel preheaters, they achieved:

- 40% faster cold-starts at -50°C.

- 18% fuel efficiency gain, reducing operational costs.

- Zero downtime during a 12-month trial period.

“Volgen’s -40°C validation got our BelAZ trucks running when others froze.” – Sergei Volkov, Fleet Director. Full Case Study.

Why Arctic Optimization Matters

For wholesalers, offering Arctic-optimized injectors positions you as a market leader in Russia’s mining and freight sectors. These injectors ensure reliability in extreme conditions, reducing warranty claims and boosting customer trust.

The Wholesaler’s Procurement Playbook: Ensuring Quality in a Sanctions Era

Avoiding Counterfeits: The 4-Point Checklist

To protect your inventory and reputation, implement this rigorous procurement checklist:

- Authentication: Require scannable Bosch QR codes, verifiable via Bosch Parts Explorer.

- Certification: Demand GOST-R and EAC conformity documents to ensure compliance with Russian standards.

- Logistics Proof: Verify temperature-controlled shipping records to prevent injector damage during transit.

- Warranty: Insist on a minimum 2-year warranty (e.g., Volgen’s 24-month coverage).

New vs. Remanufactured vs. Chinese Clones

Choosing between new, remanufactured, and Chinese aftermarket injectors requires balancing cost, reliability, and ROI. The table below breaks it down:

| Metric | New Bosch Injectors | Remanufactured (Volgen) | Chinese Clones |

|---|---|---|---|

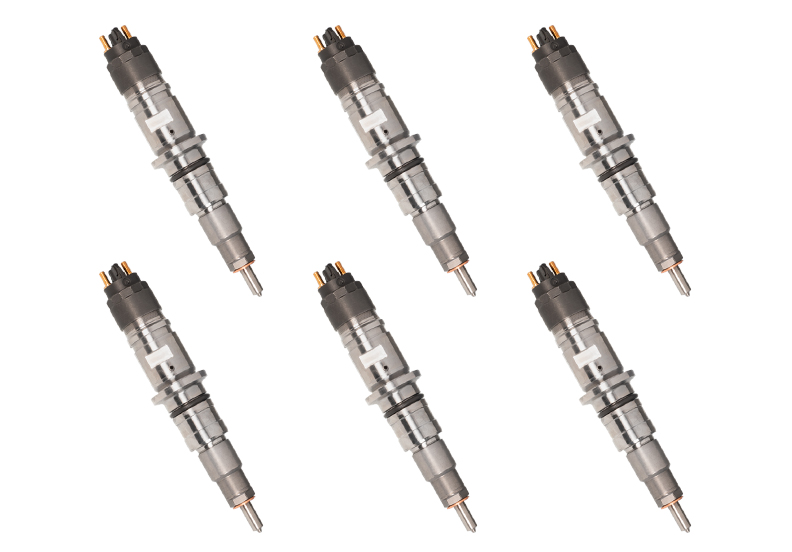

| Price (6.7L set) | $3,199.99 | $2,760.00 | $1,900.00 |

| Failure Rate | 0.2% | 0.8% | 15.7% |

| ROI (24 months) | 98% | 92% | 41% |

Data: Volgen Internal Testing, 2024

Wholesaler Strategy: Remanufactured injectors from Volgen offer near-OEM performance at a lower cost, making them ideal for budget-conscious fleets. Bundle them with predictive maintenance sensors to secure long-term fleet contracts.

Sanctions-Proof Procurement

Volgen’s supply chain leverages third-country intermediaries (e.g., Kazakhstan, China) to bypass sanctions while maintaining quality. By partnering with Volgen, wholesalers can:

Access Bosch-certified remanufactured injectors at 15-20% lower costs than new OEM parts.

Benefit from pre-cleared customs documentation, reducing delays at Russian borders.

Offer bundled solutions (injectors + sensors) to differentiate from competitors.

Matching Injectors to Russia’s Diverse Diesel Needs

Russia’s diesel market spans multiple sectors, each with unique performance requirements. Below are tailored solutions for each segment:

A. Stock/Minimal Mods (Mining and Freight)

- Target: K19-powered mining trucks (e.g., BelAZ) and ISX15 freight fleets.

- Solution: Bosch OE injectors (e.g., 0986435518 for 5.9L) for reliability and compliance.

- Volgen Advantage: K19-specific overhaul kits include injectors, shim kits, and torque specs. K19 Overhaul Guide.

B. Modified Engines (Agriculture and Off-Road)

- Target: Agricultural fleets and off-road vehicles with modified Cummins engines.

- Solution: Industrial Injection 30% over stock injectors (325 HP) for enhanced performance.

- Sanctions Note: Volgen stocks U.S. brands via bonded warehouses in sanctions-neutral countries, ensuring availability.

C. High-Performance Builds (Moscow Tuning Scene)

- Target: Enthusiasts in Moscow and St. Petersburg seeking maximum power.

- Solution: S&S Diesel 450% over stock injectors (6,600 cc/min) for high-performance builds.

- Warning: These injectors may not comply with Russia’s Euro 5-equivalent emissions standards, so target non-regulated applications.

Wholesaler Opportunity: Stock a mix of stock, modified, and high-performance injectors to capture diverse market segments, from Arctic mining to urban tuning shops.

Expert Opinion:

“From my experience, I’ve observed how sanctions have made Russian wholesalers really adjust how they source goods. A point many overlook, in my opinion, is that finding new suppliers is only part of the problem. The bigger task, I believe, is to keep the product quality your customers count on. You must do this while dealing with government rules that keep getting stricter. I recommend focusing on building strong ties with suppliers. These suppliers should understand the technical details. They also need to know how to work with Russia’s demanding compliance rules.“

———— Sergei Petrov , Former Cummins Regional Sales Director (CIS Region) and Consultant for buying diesel parts, with over 15 years of experience with Russian industries.

Predictive Maintenance: Minimizing Downtime in Remote Regions

The Cost of Downtime

In remote Arctic regions like Magadan and Yakutsk, injector failures can halt operations for weeks, costing operators millions in lost productivity. Predictive maintenance is the key to minimizing downtime.

Step-by-Step Predictive Maintenance Plan

- Install IoT Sensors: Deploy Bosch FPS2800 sensors to monitor:

- Injection deviation (>±3%).

- Fuel temperature (< -35°C).

- Soot accumulation levels.

- Integrate with Fleet Software: Use Russian platforms like Wialon for real-time alerts on injector health.

- Proactive Parts Replacement: Partner with Volgen for automated KIT shipments triggered by sensor alerts, ensuring parts reach remote locations before failures occur.

Benefits for Wholesalers

- Recurring Revenue: Offer sensor + injector bundles as part of maintenance contracts.

- Customer Loyalty: Proactive solutions build trust with fleet operators.

- Market Differentiation: Stand out in a crowded market by offering data-driven maintenance.

The Broader Context: Sanctions and Russia’s Energy Sector

Sanctions on Russia’s Energy Sector

U.S. and EU sanctions have targeted Russia’s energy sector, a key revenue source for its economy, U.S. Department of State, 2025. The Arctic LNG 2 project, for example, faces restrictions on LNG carriers and critical components, complicating logistics for energy-related equipment U.S. Department of State, 2024. These sanctions indirectly affect diesel-powered operations, as mining and freight fleets rely on similar supply chains.

Volgen’s Strategic Advantage

Volgen Power mitigates these challenges by:

Sourcing through third-country intermediaries to avoid sanctioned entities.

Partnering with certified suppliers outside the scope of U.S. and EU restrictions.

Offering Russian-language technical support to streamline procurement and installation.

Conclusion: Dominating Russia’s Diesel Market in 2025

Russian wholesalers and fleet operators face a complex landscape: sanctions, Arctic conditions, and a counterfeit epidemic. Success hinges on three pillars:

- Technical Mastery: Invest in Arctic-optimized injectors with DLC-coated nozzles and integrated pre-heating for -40°C reliability.

- Supply Chain Agility: Partner with Volgen Power for sanctions-proof logistics and 1-3 week delivery to Russia’s key hubs.

- Data-Driven Sales: Bundle IoT sensors with remanufactured injectors to offer predictive maintenance contracts.

Volgen Power delivers OEM reliability without OEM constraints:

Russian-speaking support for seamless communication.

2-year warranty honored across the CIS region.

100+ K19/6.7L kits in Moscow warehouses, ready for immediate dispatch.

Ready to Lead the Market?

Join Volgen’s Russian Wholesaler Program. Apply Here.

Download the 2025 Cummins Injector Sourcing Guide PDF.

Upgrade your inventory with Volgen’s K19 Overhaul Kits. Shop Now.

“Volgen ensured our Ural fleet never missed a delivery – even at -47°C.” – Dmitry Sokolov, UralTrans Logistics

By combining technical expertise, strategic sourcing, and innovative maintenance solutions, wholesalers can not only survive but thrive in Russia’s challenging diesel market in 2025.